Capital One Direct Deposit

Capital One Direct Deposit

If you’d like to make a deposit by phone, you can call 1-800-219-7931. We would like to show you a description here but the site won’t allow us. Jul 30, 2015 How Direct Deposit Works. On the face of it, direct deposit is straightforward. All you have to do is set up a direct deposit once with the payer, and then the recurring payment appears in your account every time the payer initiates one. Everything else happens behind the scenes. Let’s take your employer’s payroll as an example.

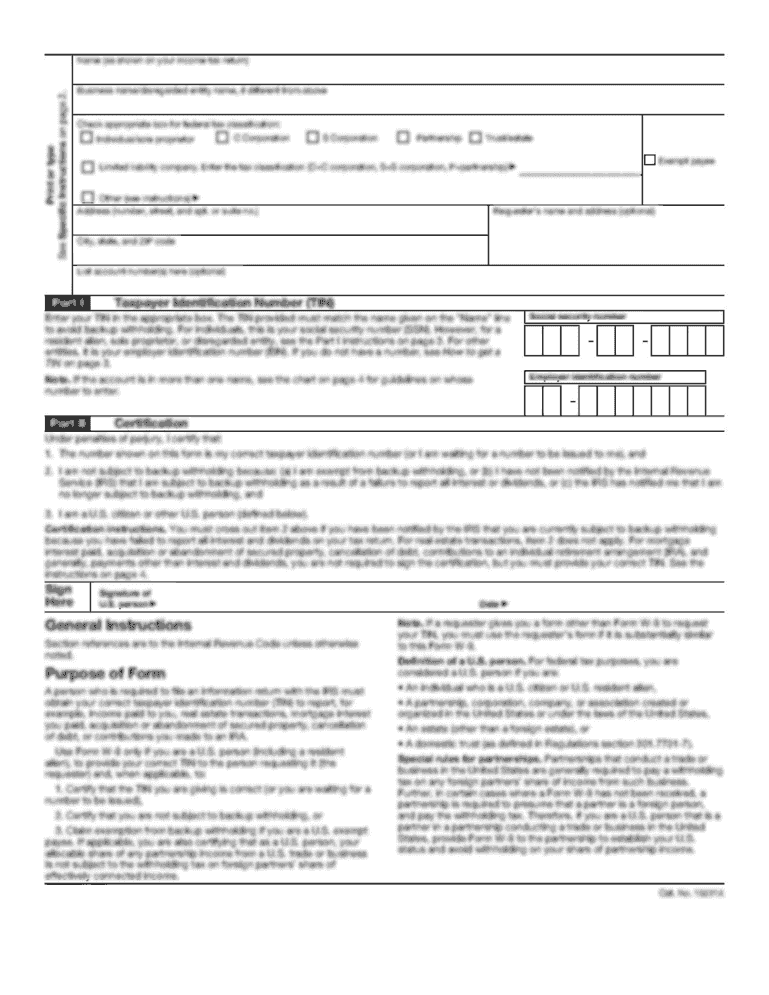

The Capital One 360 direct deposit authorization form is a blank document used to set up instant and direct payments to a customer’s checking or savings account. Capital One has a feature available for their online banking customers; users are able to sign onto their online banking, access their checking account, and select a “pre-filled” direct deposit authorization form. For those of you who are not currently banking online, you can easily take advantage of the convenience of this payment method through the use of the below form and instructions. You will need your bank’s routing number, your account number, and your personal information on hand.

- Capital One 360 Routing Number – 031176110

Step 1 – Begin by downloading the form in Adobe PDF and opening it up on your computer. If all goes well, you will be looking at a form which is identical to the one displayed below.

Step 2 – For the purposes of this tutorial, select the “Start a new Direct Deposit” option. If you need to change your information in the future, you can use this form as well and select the second option available at the top of the page. Below the check boxes, enter the following information:

- Company name

- Company address

- Company city, state, zip

- Company phone number

Step 3 – Your information will be required next, providing that you are indeed the employee. Enter in the below information and double check it for correctness before proceeding.

- Name

- Employee ID number/Account number

- Social Security number

- Full address

- Phone number

Step 4 – You will now be required to enter the Bank & Deposit information. As included in the disclaimer, for those with Capital One accounts, you will be required to choose your entity under the “Bank #1” heading. The appropriate routing number has been assigned already for each. For Capital One 360 customers, enter the name of the bank under the “Bank #2” heading, followed by the routing number (031176110). You must also enter the account number, and the amount or percentage to be deposited. Finally, the name of your employer and the date can be added before printing off the document.

Capital One Direct Deposit Post Time

Step 5 – Sign the completed form and give it to your employer or supervisor for processing.

Capital One Direct Deposit Address

ABA Routing Number: Routing numbers are also referred to as 'Check Routing Numbers', 'ABA Numbers', or 'Routing Transit Numbers' (RTN). The ABA routing number is a 9-digit identification number assigned to financial institutions by The American Bankers Association (ABA). This number identifies the financial institution upon which a payment is drawn. Routing numbers may differ depending on where your account was opened and the type of transaction made. Each routing number is unique to a particular bank, large banks may have more than one routing number for different states.

ACH Routing Number: ACH Routing Number stands for Automated Clearing House (ACH). This routing number is used for electronic financial transactions in the United States. ACH helps to improves payment processing efficiency and accuracy, and reduce expenses. Banks offer ACH services for businesses who want to collect funds and make payments electronically in batches through the national ACH network. ACH routing number is a nine digit number. The first four digits identify the Federal Reserve district where the bank is located. The next four numbers identify the specific bank. The last number is called as a check digit number which is a confirmation number. ACH Routing Numbers are used for direct deposit of payroll, dividends, annuities, monthly payments and collections, federal and state tax payments etc.

Fedwire Routing Number: Fedwire Transfer service is the fastest method for transferring funds between business account and other bank accounts. It is used for domestic or international transactions in which no cash or check exchange is involved, but the account balance is directly debited electronically and the funds are transferred to another account in real time. To complete a wire transfer, the sender must provide his bank name and account number of the recipient, the receiving account number, the city and state of the receiving bank and the bank's routing number.